From Zero To Six Figures:

Essential Skills For

New Tax Preparers

Become An IRS Authorized Tax Preparer

CEO - Preferred Accounting & Tax Services LLC

I'm an Enrolled Agent with the IRS and a seasoned small business coach who’s been helping business owners and individuals navigate the complexities of taxes since 2009.

With over 23 years of experience in tax and accounting, I've built my career on simplifying tax preparation and teaching others how to maximize their potential in this rewarding field.

My hands-on approach and proven strategies have enabled hundreds of students to succeed in making $100K or more each tax season.

In my course, I'll walk you through everything you need to know to confidently prepare tax returns, build your own client base, and thrive in a high-demand profession. If you’re ready to elevate your skills, I’m here to guide you every step of the way

Here's what you get in 3 Days of intense learning:

Master the Basics of Tax Preparation

Gain Hands-On Experience with Real-World Scenarios

Software Setups

Protect yourself as Tax professionals with ETHIC documents and templates

Learning each line item of the 1040

How to go about getting banking and ERO

Gain Knowledge of documents need to complete an accurate 1040.

Tax preparation certification

Total value: $2597 Column

Today Just $1,149 or Virtual for $949

Date:12.19.2024 - 12.21.2024

Time: 9:30AM- 5:00pm

Location:

13550 Village Park Dr, Orlando, FL 32837

FAQ'S

What are the ethical considerations for tax preparers?

One of the biggest misconceptions is that tax preparation is all about crunching numbers. In reality, it’s more about understanding tax laws, communicating effectively with clients, and helping people navigate financial decisions. Another misconception is that only accountants or people with extensive finance backgrounds can become tax preparers, but with proper training, many people from various backgrounds can be successful in this field. Lastly, some believe tax preparation is only seasonal work, but with the right client relationships and ongoing services, it can be a year-round business.

What steps should I take to become a certified tax preparer?

Start with a solid foundation by taking a tax preparation course to understand the basics. You’ll also need to obtain a PTIN (Preparer Tax Identification Number) from the IRS. This is all provided in our course. Learning from a creditable person will be key.

How can I balance work-life as a tax preparer, especially during peak taFull Widthx season?

Tax season can be intense, so planning ahead is essential. Set realistic limits on the number of clients you take on, and delegate tasks where possible. Use tax software to streamline your processes and save time. Balance is about pacing yourself, too; make time for breaks, and try to maintain regular routines outside of work. Remember, it’s okay to say no to new clients if it means protecting your well-being.

How can I build a strong client base as a new tax preparer?

Building a client base takes time, but it starts with positioning yourself as a knowledgeable, trustworthy professional. Networking is key: attend local business events, join online forums, and ask for referrals from friends and family. Specializing in a niche, like small business tax preparation, can also help you stand out. Offer valuable content, like tax tips or small business advice, through social media or newsletters to attract potential clients. Over time, satisfied clients will refer you to others.

How much math do I need to know to be a successful tax preparer?

Surprisingly, not as much as you might think! Tax software does most of the calculations. What’s more important is having a good understanding of tax laws and knowing where to find answers for specific tax questions. You’ll need basic math skills, of course, but the real skill lies in interpreting tax rules and applying them to individual cases.

How can tax preparers contribute to financial literacy in their communities?

Tax preparers are in a unique position to educate clients on budgeting, saving, and responsible financial planning. We can hold workshops or seminars, provide free resources on social media, or partner with local organizations to spread knowledge. By helping clients understand their tax situation, we empower them to make smarter financial decisions. This not only improves individual financial health but also strengthens the community as a whole.

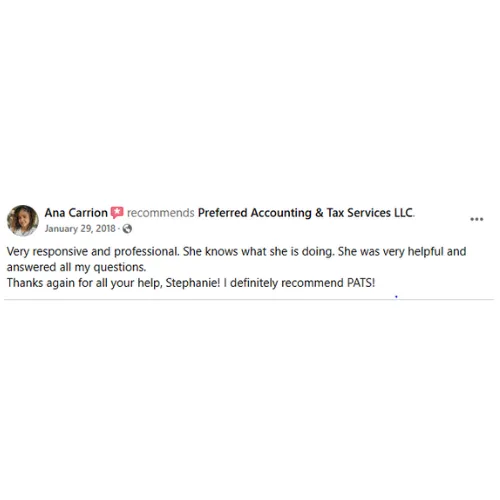

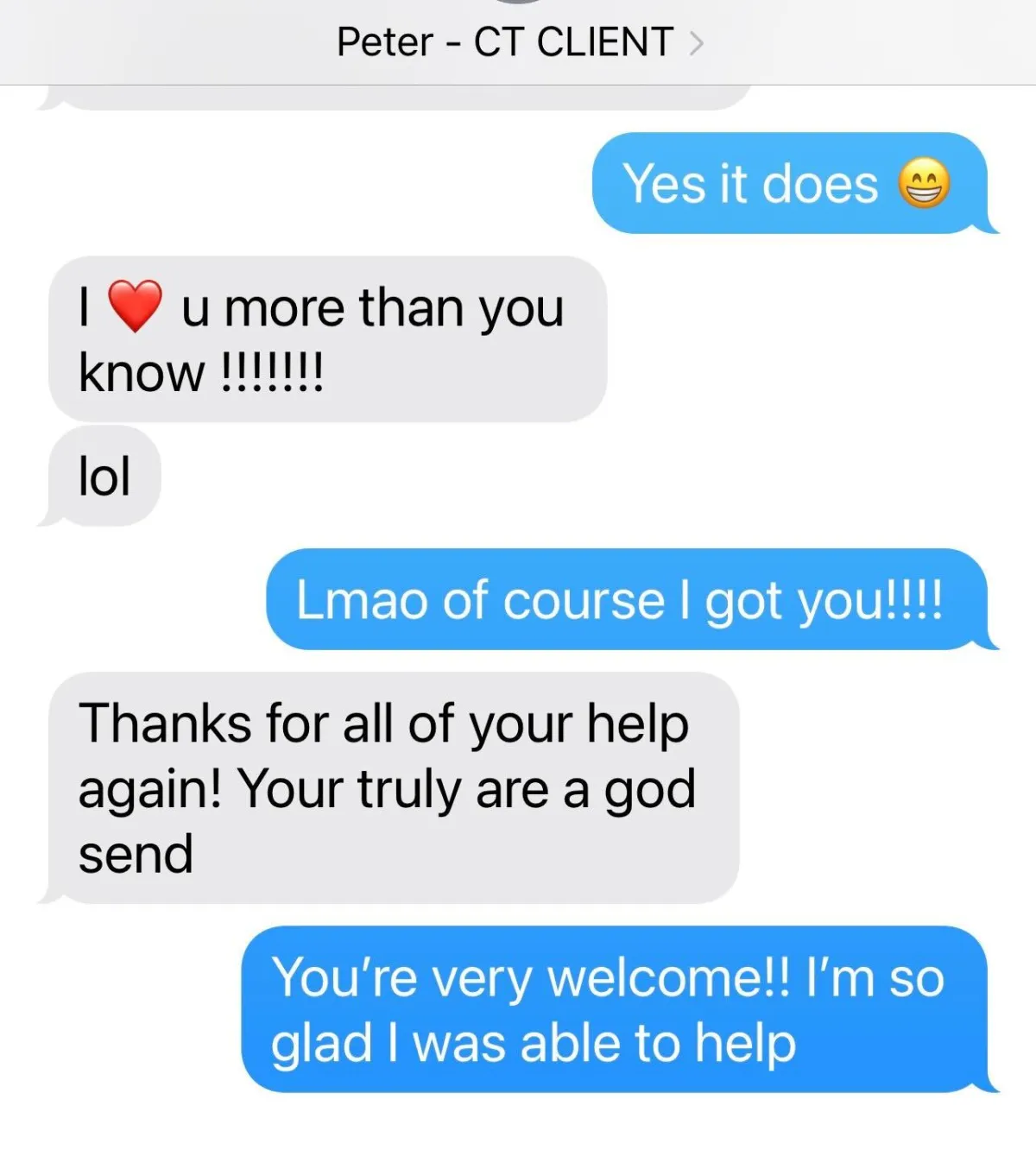

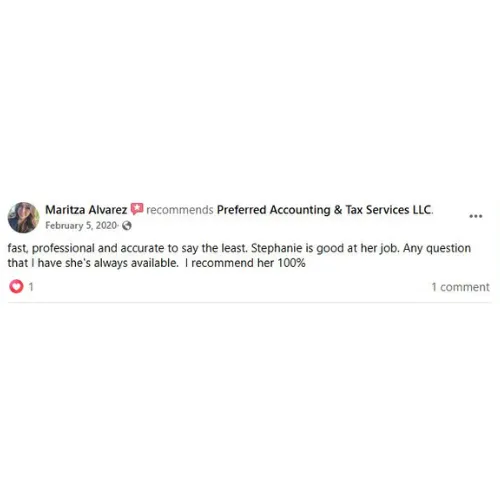

REVIEWS FROM OUR CLIENTS

"Best purchase ever!"

"Stephanie's knowledge and the way she can teach and explain such hard topics was amazing."

- Steven W.

Copyrights 2024. Preferred Accounting & Tax Services LLC |Terms & Conditions

Proudly Created By Ajoke_Digitals